From the Introduction on What’s Your Money Personality?

"I realised then that my view of family was tainted by violence and the trauma around money, and this was affecting my ability to grow financially."

After graduating with an honours degree in Finance, I thought my financial future would be secure. However, when I started working as a mining and energy analyst, I spent my first paycheque within days and struggled to hold onto money. Although I had a good understanding of finance theory, I found it challenging to apply what I had learnt to my own life.

I had a deep understanding of finance theory and could talk about anything from budgeting to economics, supply and demand, inflation, derivatives, shares, and investing, but I was struggling financially. And so, even though I had two other jobs, I decided to go travelling so that I could earn US dollars or pounds and pay off my student loans. I found work on a cruise liner and thought it would be an easy way to save money since my rent and food were paid for. Instead, I ended up becoming a shopaholic and, despite drafting several budgets, I found it difficult to save money.

I later decided to write my Graduate Management Admission Test – commonly referred to as GMAT – and got accepted into the Simmons School of Management in Boston, Massachusetts, to do my Master of Business Administration (MBA). At the time, I believed that my money issues were related to education, and that a master’s degree would change my life and my relationship with money. I graduated with US$60,000 in debt and started suffering panic attacks whenever I had to handle or talk about money.

At the same time, my uncle called to inform me that the family had been waiting for me to graduate and start earning money so that I could look after them. I was only 25, with no kids and no husband, and was being asked to take responsibility for seven adults and five children. I started a business, but it failed because I found myself unable to charge for my services, invoice people, or talk about money. I even watched The Secret, tried visualisation techniques, recited affirmations, and practised gratitude, but nothing seemed to work. There seemed to be no way out of my financial crisis.

It was at this point that a friend introduced me to vipassana meditation, a meditation practice where you take a vow of silence for 10 days to focus on meditating. During this time, I saw how every thought triggered an emotion and sensation in my body. I realised, too, that I spent most of my time worrying about money and finally understood what that worry was doing to my body.

After vipassana, I read theses on behavioural finance and economics and focused on understanding the link between emotional intelligence and money. I started writing blogs, creating money exercises, and sharing them. People started coming to me for money coaching, and the more shifts they saw, the more people they referred. Finally, I landed a publishing deal for my first book, Heart, Mind & Money: Using Emotional Intelligence for Financial Success, and paid off my $60,000 debt in three and a half years.

And so it was then I became debt-free, went back to travelling, became a nomad, and started running my business on the road. However, I found myself struggling to increase my income and lived in constant fear of my maternal family turning to me for money. This fear wasn’t unfounded, however, because my uncle and one of my aunts, both of whom were career professionals, often alluded to the fact that it was now my turn to look after the family. My aunt had even tried to shame my sister and me at a family gathering for setting financial boundaries.

I would have nightmares of being rejected by my family, enduring fights about money and being shouted at for not doing enough. I would wake up shaking and scared, convinced that the only way to keep myself safe from the fighting and to be loved by my family was to make very little money so I could always say I don’t have any money. After all, both my mom and uncle had gotten out of the cycle of family drama by quitting their jobs.

I realised then that my view of family was tainted by violence and the trauma around money, and this was affecting my ability to grow financially. The mindset that had helped me get out of debt couldn’t help me create a consistent stream of income, grow my business, or create passive income streams.

I started questioning why I felt the way I did about making money and how my family dynamics and history impacted my earning potential and business. I went back to my research on emotions and money and noticed that finance and economics theses looked at money through an individual, Western lens and rarely explored family dynamics around money, especially in Black families. Of course, this made sense, because traditional finance and economics works on the premise that we are rational human beings and, as a result, we make rational financial decisions. But the reality is that humans are also emotional beings, especially when it comes to our family and friends. That’s why I found myself struggling with financial boundaries and focusing on wealth creation when it came to my family – setting boundaries seemed like I was risking family rejection and going against tradition.

It also became obvious to me that most financial advice ignores family dynamics, especially in Black families, where emotions, ancestors, racial trauma, and family ties play a crucial role in financial decisions. And so I started to realise that there was a need for conversations about money and family dynamics, especially in marginalised communities and decided to focus on this in my coaching and writing.

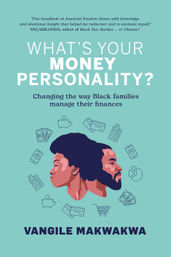

What's Your Money Personality?

by Vangile Makwakwa

When it comes to money matters, are you a lioness who leads the tribe, a dolphin who ducks and dives, or an ostrich who buries its head in the sand? This first-of-its-kind book explores and unpacks the intricate world of money archetypes in Black families in South Africa.

Discover the secrets behind your unique money personality and unravel the intricate web of cultural, generational and personal influences that shape your financial behaviour. Eye-opening anecdotes, relatable case studies and expert insights empower you to understand, embrace and transcend your money archetype.

What's Your Money Personality? will change the way you view and manage your individual and family finances.